LEARN

WHAT GOES INTO MY MORTGAGE RATE?

A mortgage rate is the interest you pay on your home loan. Your monthly mortgage payment includes the interest owed on the loan, plus a portion of the remaining principal balance. A lower rate means lower monthly payments. Even as little as a 1% difference in rates, can save you a significant amount of money. We know finding the perfect mortgage can be confusing. Please feel free to give us a call and one of our dedicated team members will be happy to answer any questions you might have.

When the economy is strong, rates often go up. During a weak economy, rates go down. Lenders also analyze economic data to try to forecast potential economic growth and slow down, and set rates accordingly.

Economies become volatile during a crisis and other events taking place domestically or internationally. This impacts investor confidence and cause interest rates to change.

To keep inflation in check, the Federal Reserve controls the amount of money flowing through the economy by raising and lowering interest rates, and inserting more cash when necessary by buying Treasury bonds. This, in turn, lowers interest rates and promotes economic activity.

The rate you’ll be offered is dependent on the factors above, as well as your financial situation. This includes your credit score, loan amount and term, area of your home purchase, and down payment. All of these factors go into determining your mortgage rate.

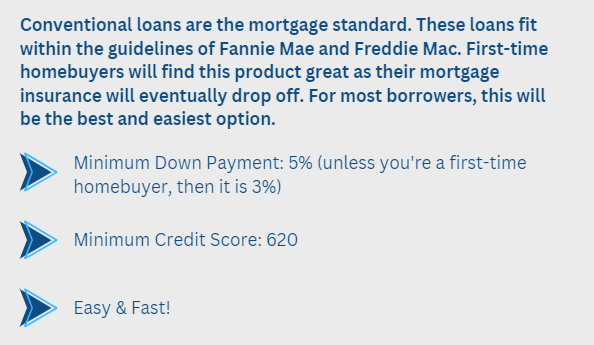

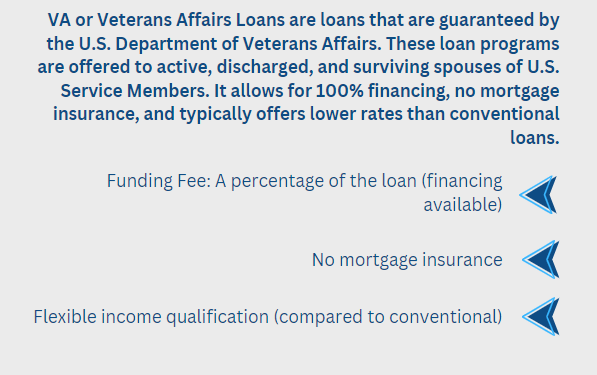

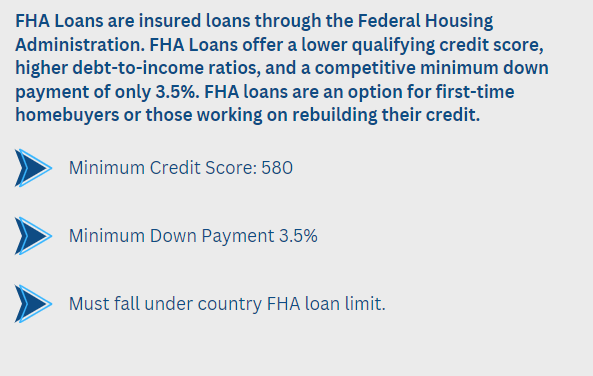

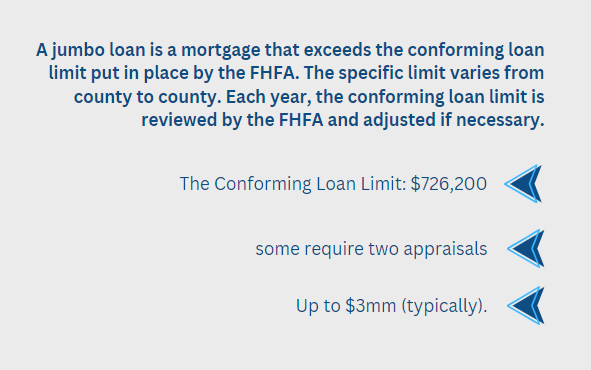

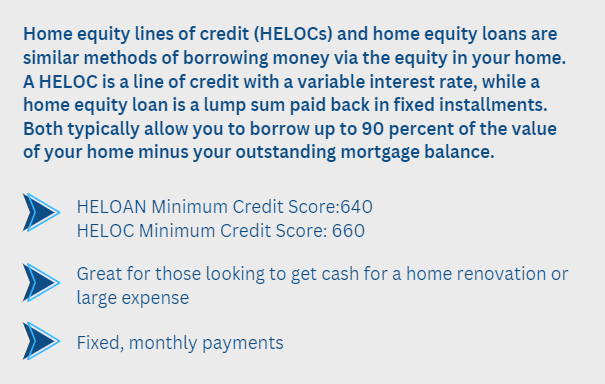

LOAN PROGRAMS